Over the past decade, the way companies manage their finances has evolved dramatically. Accounting is no longer confined to spreadsheets, paper ledgers, and bulky desktop installations. Today, 82% of small firms utilize cloud accounting to handle their finances. SMEs are able to match the efficiency and operations pace necessary for competing in the modern business environment with the aid of cloud accounting solutions.

Cloud-based solutions allow businesses to enable remote work, automate financial record keeping, and collaborate safely with teams and accountants from any location. What began as a way to be more cost-effective when starting your business is now the accounting model for companies of every size.

This guide will help explain cloud accounting, its differences from traditional software, and what it is. We will also review 10 best cloud-based accounting software with features, some of the pricing, and the best use cases. Finally, we will discuss how to pick the right platform, benefits to expect, and what industries benefit the most.

TL;DR:

Cloud accounting has become the backbone of modern finance management — 82% of small firms now rely on it to streamline operations, enable remote access, and automate bookkeeping. Unlike traditional on-premise systems, cloud software provides real-time data, lower IT costs, and seamless integrations with banks, CRMs, and e-commerce tools.

| Software | Key Features | Pricing | Best For |

|---|---|---|---|

| QuickBooks Online | • Real-time tracking • Automated reconciliation • Invoicing • Payroll add-ons • Extensive reporting • Large app marketplace |

Starts at $25–$30/month | Small to mid-sized businesses seeking full-featured, widely supported accounting with robust integrations |

| Xero | • Unlimited user access • Automated bank reconciliation • Invoicing • Expense tracking • Customizable dashboard • Extensive app marketplace |

Plans start at around $15/month | Service-based businesses and teams that prioritize collaboration and ease of use |

| FreshBooks | • Easy invoicing • Integrated time and project tracking • Expense management • Recurring billing • Simple reporting |

Starts at around $19/month | Freelancers, consultants, and small agencies needing straightforward billing and expense tracking |

| Zoho Books | • Invoicing with payment gateways • Expense management • Project tracking • Multi-currency support • Workflow automation • Zoho ecosystem integration |

Affordable tiered plans, free or low-cost options for small businesses | Startups and growing businesses seeking automation at an affordable price |

| Wave Accounting | • Professional invoicing • Expense tracking • Automated bank connections • Core financial statements • Simple mobile functionality |

Free for core accounting and invoicing, paid add-ons available | Solo entrepreneurs and microbusinesses seeking a cost-effective starting point |

| Global PayEX | • Receivables automation • Payment reconciliation • Cash application • Multi-entity support • ERP integration |

Custom pricing based on business size and integration needs | Enterprises with complex receivables processes or heavy trade finance requirements |

| MYOB (Cloud) | • Invoicing • Expense tracking • Automated bank reconciliation • Payroll support • Customizable reporting tools |

Regional pricing through tiered subscriptions | Businesses in Australia and New Zealand seeking compliant, cloud-ready accounting solutions |

| Tazweed | • Core cloud accounting functions • Invoicing • Expense management • Regional tax and compliance tools |

Varies by region | SMBs in markets where Tazweed operates and localized support is essential |

| SlickPie | • Invoicing • Expense tracking • Automatic data entry (MagicBot) • Basic reporting • Cloud browser access |

Free plan with optional paid upgrades | Startups and microbusinesses needing basic cloud accounting tools |

| MTDsorted | • Digital tax filing for MTD compliance • Transaction import • VAT submissions • Integration with existing records |

Based on usage and business size | UK businesses looking to streamline MTD compliance without overpaying for enterprise-grade tools |

Why it matters: Cloud platforms offer scalability, automatic updates, real-time collaboration, and improved financial visibility. Choosing the right tool depends on your business size, industry, integration needs, and budget.

What is Cloud Accounting Software?

Cloud accounting software is financial management software that is run remotely and accessed through the internet. With traditional systems, you download the software to local machines. With cloud accounting, you just log in from any device and manage your finances in real-time.

Your data is securely stored in encrypted cloud servers, and the provider manages updates, backups, and security patches, resulting in much less IT overhead, and much more time you can spend running your business.

Most cloud accounting platforms are capable of integrating with banks, payment gateways, customer relationship management (CRM) tools, and e-commerce platforms, thus creating a complete financial ecosystem that is so much more than bookkeeping.

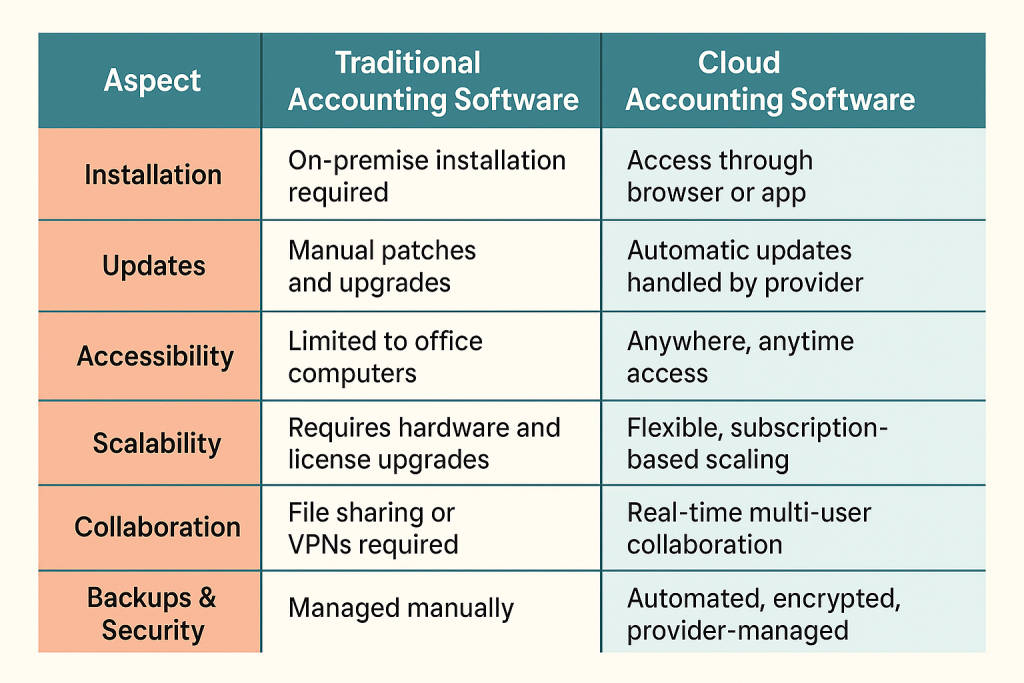

Cloud Accounting vs Traditional Accounting Software

Shifting to the cloud is not just about convenience; it’s a strategic upgrade. Here’s how cloud accounting compares with traditional systems:

With cloud software, teams work with live data, not outdated backups. Financial reporting becomes more accurate and timely, enabling faster decision-making.

How Does Cloud Accounting Software Work?

When a company registers for a cloud accounting platform, it can safely use a browser or mobile application to access its financial data. The usual workflow proceeds as follows:

- Sign Up and Configure: establish an account, add company details, configure fiscal periods, and tax parameters.

- Link Financial Accounts: Set up connections to bank accounts and credit cards so that transactions can automatically feed into the accounting system.

- Enter Transactions: Create invoices, expenses, bills, or bulk data imported.

- Reconcile Accounts: Verify that you have invoices and receipts that confirm the transactions you record.

- Generate Reports: Get profit and loss, balance sheet, and cash flow reports in real-time.

- Collaborate: Invite accountants, and team members with access roles.

- Stay Current: Enjoy automatic updates and security, and automatic back-ups, without having to think about it.

According to PCMag, businesses that switch to cloud accounting report a 30-40% reduction in manual bookkeeping time within the first six months.

Top 10 Cloud-Based Accounting Software Solutions

The Cloud Accounting Software Market, valued at USD 5.39B in 2025, is projected to reach USD 7.75B by 2029, growing at a 9.5% CAGR. As a result of that growth, we have also seen a wave of innovation taking place, meaning that it is crucial to adopt tools that meet your specific business needs.

Here are ten of the most-used solutions, including both global leaders and specialized regional platforms:

1. QuickBooks Online

QuickBooks Online still reigns supreme in the cloud accounting market. With a well-established ecosystem, millions of users, and decades of trust by small and medium businesses, the platform offers core accounting and invoicing, payments, and payroll combined with terrific reporting and a generous app marketplace. Many businesses turn to QuickBooks because they rely on that brand name and integrations. QuickBooks will be a reliable choice for companies that want an all-in-one solution, which integrates with all of their needs, and also provides strong support from their accountant and users.

Key Features

- Real-time income and expense tracking

- Automated bank and credit card reconciliation

- Invoicing and payment processing

- Payroll add-ons for end-to-end financial management

- Extensive reporting and dashboard capabilities

- Large marketplace of third-party app integrations

- Multi-user support with granular permissions

Pros

- Mature ecosystem with excellent accountant familiarity

- Strong integration network

- Reliable customer support

- Scalable plans for different business sizes

Cons

- Add-ons can increase total cost quickly

- Some advanced features locked behind higher tiers

- Occasional learning curve for new users

Pricing

Starts at approximately $25–$30 per month for basic plans, with higher tiers offering additional functionality and user seats.

Best For

Small to mid-sized businesses seeking a full-featured, widely supported accounting solution with robust integration options.

2. Xero

Xero is recognized for its clean design, user-friendly interface, and robust collaboration features. It allows multiple users to work together in real-time without needing complicated IT builds. Accountants and business owners tend to prefer using Xero because of its flexibility for use on the go, and its app marketplace. Users are able to set up invoicing, bank reconciliation, expenses, and reporting with great ease making it the perfect fit for businesses that depend on services, value collaboration, prefer a simpler user experience and a remote work ecosystem.

Key Features

- Unlimited user access on many plans

- Automated bank reconciliation

- Invoicing and bill management

- Expense tracking and claims

- Customizable dashboard and reports

- Extensive app marketplace

Pros

- Excellent collaboration features

- Intuitive interface that minimizes training time

- Strong mobile apps for on-the-go work

Cons

- Payroll features vary by region

- Some add-ons are required for advanced capabilities

Pricing

Plans start at around $15 per month, with higher tiers offering more features and transaction limits.

Best For

Service-based businesses and teams that prioritize collaboration and ease of use.

3. FreshBooks

FreshBooks emphasizes simplicity and ease of use for freelancers, consultants, and small service firms. FreshBooks performs well in invoicing, time tracking, and expense management, but not necessarily in complex accounting situations. FreshBooks helps service providers bill clients quickly, projects with the right time, and keep a pulse on cash flow without a large up-front learning curve. Its interface is clean and it does have some project features, which help a lot for someone who just wants to use practical financial tools to get better control over their hours, clients and projects.

Key Features

- Easy invoicing and estimates

- Integrated time and project tracking

- Expense management

- Recurring billing and payment reminders

- Simple reporting for cash flow and profitability

- Integrations with popular business apps

Pros

- Very beginner-friendly

- Strong for project-based or time-billing work

- Clean, modern UI

Cons

- Limited inventory and advanced accounting functions

- Some features locked to higher plans

Pricing

Starts at around $19 per month, with advanced plans for additional clients and automation features.

Best For

Freelancers, consultants, and small agencies that need straightforward billing and expense tracking.

4. Zoho Books

Zoho Books is notable for its automation options, price range, and integration with other Zoho applications. It was created for small to medium-sized businesses that are looking for solid accounting software without breaking the bank. Users can automate invoicing, workflows, and reconciliation, as well as enjoy multi-currency support and project tracking features. Zoho Books is especially appealing to businesses that already use Zoho CRM or other tools, as it provides one ecosystem for applications that can improve business efficiency and reduce the use of multiple disconnected platforms.

Key Features

- Invoicing and billing with integrated payment gateways

- Expense management and bank reconciliation

- Project tracking and task management

- Multi-currency support in higher tiers

- Workflow automation for routine financial tasks

- Deep integration within the Zoho ecosystem

Pros

- Strong value for money

- Excellent automation and customization

- Ideal for businesses already using Zoho products

Cons

- Some modules have usage limits on lower tiers

- Advanced reporting requires higher plans

Pricing

Zoho Books is known for its affordable tiered plans, with free or low-cost options for small businesses in some regions.

Best For

Startups and growing businesses seeking automation at an affordable price.

5. Wave Accounting

Wave has developed an impressive reputation as a superior free cloud accounting application for freelancers and small businesses. Invoicing, expenses, and a basic variety of reporting functionality are deeply integrated. It provides all of this for no cost, making it ideal for new entrepreneurs. Wave is not as tough (or advanced) as some modules in the paid platforms, but it provides enough functionality with a simplified interface for free. Therefore, it’s a natural starting point for microbusinesses who want to digitize their accounting function without incurring a monthly cost.

Key Features

- Professional invoicing and estimates

- Expense and receipt tracking

- Automated bank connections

- Core financial statements

- Simple mobile functionality

Pros

- Free core features with no hidden subscription

- Simple and clean interface

- Ideal for small scale operations

Cons

- Limited advanced functionality

- Payroll and payments are paid add-ons

- Customer support options are basic compared to paid tools

Pricing

Free for core accounting and invoicing. Optional add-ons for payments and payroll incur extra costs.

Best For

Solo entrepreneurs and microbusinesses seeking a cost-effective starting point.

You May Also Read: Top Free Accounting Software

6. Global PayEX

Global PayEX specializes in automating a corporation’s Accounts Receivable and trade finance processes. It is less an entire accounting suite and designed specifically for the needs of corporates with more complex receivables workflow, multi-entity organizational structures, and access to banking integrations. Global PayEX’s tools provide reconciliation, cash application, and AR digitization functionality. Global PayEX is designed for larger companies attempting to update AR functionality, not for replacing their entire ERP. In general, Global PayEX works best when used as a system along-side existing accounting or ERP platforms.

Key Features

- Receivables automation

- Payment reconciliation and cash application

- Integration with ERPs and banking systems

- Multi-entity support

Pros

- Strong in AR digitization for larger businesses

- Supports complex enterprise workflows

Cons

- Not a full accounting suite like QuickBooks or Xero

- Best suited as a complementary system, not standalone

Pricing

Custom pricing based on business size and integration needs.

Best For

Enterprises with complex receivables processes or heavy trade finance requirements.

7. MYOB (Cloud Version)

MYOB continues to be a reputable brand in Australia and New Zealand, and the cloud version provides that same reliability on the web. The platform emphasizes regional compliance with payroll, invoicing, bank reconciliation, and reporting, all while maintaining a user-friendly interface. Businesses that have used MYOB in the past will easily transfer to the cloud version because of the continued focus on local compliance. MYOB may have a smaller number of integrated apps on their global membership network than QuickBooks or Xero, but they continue to provide strong regional support while also providing a practical product for compliant financial services.

Key Features

- Invoicing and expense tracking

- Automated bank reconciliation

- Payroll support for regional compliance

- Customizable reporting tools

Pros

- Strong regional compliance features

- Reliable support in Australia and New Zealand

- Familiar interface for existing MYOB users

Cons

- Less global integration compared to larger platforms

- Feature depth varies by region

Pricing

Regional pricing applies, typically through tiered subscriptions.

Best For

Businesses in Australia and New Zealand seeking a compliant, cloud-ready accounting solution.

8. Tazweed

Tazweed is a regional accounting platform that meets localized tax and compliance requirements. Although Tazweed does not have the global scale of the major players, it provides the cloud accounting essentials needed: invoicing, expense tracking and compliance tools, all catered to its markets. It’s easy to use, which allows small and medium businesses to implement it easily. Tazweed is recommended for companies operating in regions where localized support, compliance and market differences are priorities.

Key Features

- Core cloud accounting functions

- Invoicing and expense management

- Regional tax and compliance tools

Pros

- Tailored to local market requirements

- Simple, functional interface

Cons

- Limited integrations and global support

- Smaller community and documentation

Pricing

Varies by region.

Best For

SMBs in markets where Tazweed operates and where localized support is essential.

9. SlickPie

SlickPie is designed for small businesses that want a simple, inexpensive cloud accounting solution. It has a lightweight focus on the primary functions that many small businesses need such as invoicing, expense tracking, and a MagicBot tool, which provides automated data entry. It is quick to setup, has a basic learning curve, and is ideally suited for startups or microbusinesses that just need essential financial tools without the hassle and costs associated with much more complicated features that they are not going to use anyway. Its ecosystem of applications is smaller, but with its free plan, simplicity, and core function, it is a viable and practical entry-level cloud accounting app.

Key Features

- Invoicing and expense tracking

- Automatic data entry through MagicBot

- Basic reporting and dashboards

- Cloud access via browser

Pros

- Free plan available

- Quick setup with minimal learning curve

Cons

- Limited functionality for larger businesses

- Smaller support and integration ecosystem

Pricing

Free plan with optional paid upgrades.

Best For

Startups and microbusinesses needing basic cloud accounting tools.

10. MTDsorted

MTDsorted is aimed at businesses in the UK, who need to comply with the government’s Making Tax Digital (MTD) initiative. Unlike a full accounting suite, it provides businesses with facilitation of VAT submissions, transaction importing, and online tax filing. By using MTDsorted, SMEs will find the tax compliance process much easier, while also reducing the workload to prepare VAT and other filings on time. MTDsorted also works with your existing accounting records, so if you are already using desktop or cloud accounting tools, it can serve as a practical add-on to improve your tax workflow.

Key Features

- Digital tax filing for MTD compliance

- Transaction import and categorization

- VAT submissions

- Integration with existing accounting records

Pros

- Simple, compliance-focused interface

- Reduces administrative overhead for UK tax reporting

Cons

- Primarily focused on tax compliance, not full accounting

- Limited features beyond MTD requirements

Pricing

Based on usage and business size.

Best For

UK businesses looking to streamline MTD compliance without overpaying for enterprise-grade tools.

You May Also Read: Best Accounting Software For Mac

How to Choose a Cloud Accounting Software

Key Factors to Consider:

- Business Size & Scale: Pick a software solution that can accommodate expansion as the business grows.

- Feature Requirements: Determine if invoicing, inventory, forex, or tax modules are required.

- Integration Ecosystem: Determine if there is compatibility with your banking, CRM and e-commerce solutions.

- Ease of Use: An intuitive design saves training time and mistakes.

- Security & Compliance: Look for encryption, regular backups, role-based access to applications and compliance certifications.

- Cost Structure: Analyze the base subscription, add on costs, fees on transactions, and any hidden costs.

- Support & Community: Reliable support as well as an established community can help in the use of the software.

- Migration Path: Think about how easily you can import your data from your existing system.

9 Key Benefits of Cloud Accounting Software

Cloud accounting offers significant benefits in many ways:

1. Accessibility

Access your data from anywhere (secured) whether you are on a device or time zone.

2. Real-Time Data

Quick transaction syncing for fast reporting and more informed decisions.

3. Automation

Recurring invoices, payment reminders, expense categorization, and bank reconciliations are automated to save you time.

4. Security

All major providers implement encryption, multi-factor authentication, and automated backups to protect sensitive data.

5. Integration

Easy connection to banks, CRMs, payroll tools, and tax platforms (CPA) to create a connected financial ecosystem.

6. Scalability

It’s simple to add users, modules, or storage to your growing company without extensive infrastructure needs.

7. Lower Costs

Avoid high upfront fees for licenses and reduce IT maintenance (staff or cost).

8. Automatic Updates

Open your accounting application to the new features, security patches, or apps to open and plan, no manual install.

9. Collaboration

Multiple users can access the same information at the same time to ensure an accountant or other financial specialists can collaborate faster.

8 Key Features of Cloud Accounting Software

When evaluating platforms, prioritize these features:

- Invoicing and Billing Automation

- Expense Tracking and Receipt Scanning

- Bank Reconciliation and Feeds

- Financial Reporting and Analytics

- Real-Time Data Synchronization

- Multi-Currency Support

- Inventory Management

- Project Tracking and Time Management

These capabilities form the backbone of modern accounting workflows.

Which Business Industries Need Cloud-Based Accounting Software?

Virtually any industry can capitalize, but a number of industries should see disproportionately higher return on investment.

- Service and Consulting Companies – Require invoicing, time tracking, and simple collaboration.

- E-Commerce and Retail Companies – Depend on real-time inventory and multi-channel integrations.

- Freelancers and Solopreneurs – Appreciate simplicity, automation, and affordability.

- Manufacturing and Wholesale Companies – Require inventory management and cost accounting.

- Professional Services – Need accurate project tracking and billing.

- Startups and Tech Companies – Depend on scalable, integration-friendly platforms.

- Companies located in UK/EU – Require VAT and MTD compliance.

- International Companies – Require multi-currency and tax flexibility.

FAQs

1. How Much Does Accounting Software Cost?

Basic plans start around $15–$30 per month. Some offer free tiers with limited functionality. Costs increase with additional users, modules, and advanced features.

2. How Do You Set Up Accounting Software?

Sign up, configure business settings, connect bank accounts, import transactions, and set permissions for users. Most platforms provide onboarding wizards.

3. What’s the Best Free Accounting App for Small Businesses?

Wave is a popular free option, while Zoho Books offers free plans in select regions.

4. Can You Manage Expenses and Bills With Accounting Software?

Yes. You can record expenses, track vendor bills, categorize spending, and reconcile with bank feeds.

5. Can You Use Accounting Software on Your Phone?

Most modern cloud solutions have mobile apps for iOS and Android, allowing invoicing and expense tracking on the go.

6. Can I Switch from Desktop to Cloud Accounting Easily?

Many providers offer migration tools to import data from spreadsheets or desktop systems. Some manual mapping may be required for complex setups.

7. What Integration Options Are Available?

Top platforms integrate with banks, payment gateways, CRMs, payroll tools, e-commerce systems, and tax platforms to create a unified workflow.

Final Thoughts

Cloud accounting is more than a trend; it’s now the backbone of businesses globally. Whether you’re a freelancer invoicing clients or a growing company involved in complex multi-entity operations, there is a cloud solution to suit your needs.

Choosing the right platform, and making effective use of automation, can reduce manual mistakes, provide instant reporting, and elevate accounting from administrative to strategic function.