Taking control of your finances can be daunting when working as a freelancer, sole trader, or independent business owner. Once you’ve dispatched your invoices, recorded your business expenses, submitted your tax return, and ensured your business remains compliant, there’s a lot to manage. Fortunately, the right accounting software for self-employed people can help to make life a little less stressful by automating your core tasks and keeping your financial information organized, freeing you to focus on your business growth rather than spreadsheets and accounts to prepare. A recent survey found that 64.4 % of small business owners use accounting software to simplify their bookkeeping.

In this guide, we have researched and reviewed the 8 best accounting software for the self-employed, along with key features, prices, pros & cons and who it is best suited to.

What is Self-Employed Accounting Software?

Accounting software for self-employed individuals is tailored for freelancers, consultants, or independent contractors who do business on their own. In contrast to enterprise resource planning (ERP) systems developed for larger organizations, self-employed accounting software is built for simplicity and low cost to create an automatic flow of business into one location.

Typical activities would include the following:

- Creating and sending invoices that appear professional

- Capturing and categorizing business expenses

- Reconciling account activity using bank statements

- Preparing tax estimates and filing tax documents

- Tracking milliseconds and time for billable hours

- Generating documents that display cash flow and profits

This software commonly comes with mobile app integration, and is easy to access and manage for self-employed individuals. The best accounting software captivates an individual’s lifestyle without impeding their productivity.

Top 8 Self-Employed Accounting Software Options

Below are the top picks, based on features, ease of use, pricing, and suitability for different business types.

1. QuickBooks Self-Employed

QuickBooks Self-Employed is a top-rated offering designed specifically for freelancers and sole proprietors who want an easy solution paired with tax support in one package. It automatically categorizes expenses, tracks mileage, and connects directly to TurboTax for quarterly tax estimates. The mobile app makes it easy to take pictures of receipts and send invoices while on the go. While there are limited reporting capabilities as part of the QuickBooks Online suite, it serves the self-employed person well with tools for daily accounting that are fast and reliable.

Features:

- Automated expense categorization

- Invoicing and payment tracking

- Tax estimation and mileage tracking

- Direct integration with TurboTax

- Mobile app for on-the-go tracking

Pros:

- Excellent for tax prep and quarterly estimates

- Strong mobile app functionality

- Bank reconciliation and mileage tracking built-in

Cons:

- Limited scalability hence it is not ideal for larger teams

- Reporting features are basic compared to full QuickBooks Online

Pricing: Starts at $15/month. Discounts often available for new users.

Best For: Freelancers who want all-in-one bookkeeping and tax tools.

You May Also Read: 10 Best QuickBooks Alternatives

2. Wave Accounting

Wave is one of the top free accounting applications for freelancers and sole proprietors. Users can utilize unlimited invoicing, expense tracking, and receipt scanning with Wave, all without hidden payments. Wave’s streamlined interface is easy to learn, which makes it a great app for beginners. However, unlike other advanced accounting applications, Wave does not have features like project management tools or time tracking functions, so it is more ideal for an individual who simply wants a professional invoice and accurate books without a monthly charge. Optional paid payroll and payment services are available.

Features:

- Unlimited invoicing and expense tracking

- Basic reporting tools

- Bank account integration

- Receipt scanning via mobile app

- Optional paid payroll add-on

Pros:

- Free core features with no hidden charges

- Easy to set up and use

- Professional invoices with custom branding

Cons:

- No built-in time tracking

- Limited integrations compared to paid competitors

Pricing: Free, with optional paid payment processing and payroll services.

Best For: Self-employed individuals looking for a free accounting solution.

3. FreshBooks

FreshBooks is a service aimed at self-employed professionals who work with clients and need effortless invoicing tasks. FreshBooks does a great job of making customized invoices, scheduling repeat invoicing, and tracking billable hours. There is even a built-in project management function for freelancers to work with some of their clients, while tracking expenses and income. The mobile app is strong, with functions to log mileage and invoice clients on the go. While FreshBooks has limited advanced accounting reports, it works well for creative professionals, consultants, and service providers who want to optimize work for client-facing financial needs.

Features:

- Customizable invoicing with automated reminders

- Time tracking for billable hours

- Expense and mileage tracking

- Project management tools

- Integrations with payment gateways like Stripe and PayPal

Pros:

- Exceptional invoicing and client management

- Great for tracking time and expenses

- Modern, intuitive interface

Cons:

- Advanced accounting reports are limited

- Can become expensive as you scale users

Pricing: Starts at $19/month (Lite plan), with higher tiers for more clients and features.

Best For: Freelancers and service providers who need time tracking and client billing.

4. Zoho Books

Zoho Books is truly one of the best small business accounting software options on this list because it is affordable and has great automation capabilities. Features include recurring invoices, project tracking, expense categorization, and even tax compliance tools. Zoho Books also allows users to automate workflows to eliminate repetitive work. Its integration with the Zoho family of apps appeals to existing Zoho app users. While there can be a learning curve to Zoho Books for beginners, it can be a highly scalable solution since it has a free plan for small revenue generation and multiple tiered paid plans for growing companies.

Features:

- Automated workflows and recurring invoices

- Expense and project tracking

- Multi-currency and multi-user support

- Tax compliance tools and reports

- Integration with Zoho’s business suite

Pros:

- Affordable pricing with excellent value

- Strong automation features

- Ideal for businesses already using Zoho ecosystem

Cons:

- Learning curve for beginners

- Some features require higher-tier plans

Pricing: Free for businesses with revenue under $50K; paid plans start at $20/month.

Best For: Sole traders and small businesses needing strong automation and integrations.

5. Xero

Xero is recognized for its highly intuitive reporting, dashboard-and hundreds of integrations, yet it automates bank reconciliation, allows multi-currency transactions to be dealt with, and includes mobile features such as sending invoices and capturing receipts. The marketplace features hundreds of third-party integrations, which is why Xero is the best for freelancers who want that agility in scaling. It is a bit more than other simpler apps-still-perfect for self-employed professionals who want in-depth financial insight and are planning to scale.

Features:

- Bank feeds and reconciliation

- Advanced reporting and dashboards

- Invoicing, expenses, and project tracking

- Mobile app for invoices and receipts

- Third-party app marketplace

Pros:

- Excellent reporting and customization

- Strong bank reconciliation features

- Integrates with a wide ecosystem of tools

Cons:

- Slightly higher price point

- Can be overkill for simple freelancing needs

Pricing: Starts at $15/month (Early plan), with higher tiers for growing businesses.

Best For: Self-employed professionals who need powerful accounting and reporting.

6. TrulySmall Accounting

TrulySmall Accounting specializes in simplicity and affordability for self-employed individuals who need to keep track of bookkeeping without extended bells and whistles. It imports transactions in the background, makes invoicing easy, and organizes receipts in a clean dashboard. The software is designed to be mobile-friendly, making it easy for busy entrepreneurs to manage their bookkeeping from anywhere. While it does not have advanced reporting features, or the ability to fit a more traditional accounting practice, which larger firms need to serve their clients, it is a solid option for a straightforward, modern tool to help with financial management every day without the complexity of larger platforms.

Features:

- Automated transaction imports

- Basic invoicing and receipt management

- Financial reporting dashboard

- Easy-to-use mobile app

Pros:

- Affordable and intuitive

- Clean, modern interface

- Good for straightforward bookkeeping

Cons:

- Limited advanced features

- Not suited for larger or complex businesses

Pricing: $20/month after a free trial.

Best For: Solo entrepreneurs wanting simple, modern accounting at a low price.

7. ZipBooks

ZipBooks provides slightly more flexibility with its free and paid accounting features. The free plan includes invoicing, expense management, and basic reporting, and each paid level offers time tracking, smart tagging, and advanced but easy to understand analytics. The interface makes it simple to navigate easily, and the smart insights are useful for understanding spending patterns. Although it has fewer integrations than QuickBooks or Xero, ZipBooks is a strong option for freelancers who plan to start free and grow into it as their business develops.

Features:

- Invoicing and expense management

- Time tracking and reporting

- Smart tagging for better insights

- Basic bank integration

Pros:

- Free starter plan with solid core features

- Simple and user-friendly interface

- Offers smart recommendations via AI

Cons:

- Advanced features locked behind paid tiers

- Fewer integrations than big players

Pricing: Free basic plan; paid plans start at $15/month.

Best For: Freelancers looking for a blend of free and premium accounting tools.

8. Bonsai

Bonsai is not just accounting software, but a full business management solution for freelancers. In addition to invoicing and expenses, contracts, proposals, and client management is all available. Bonsai includes tax calculations and time tracking, so freelancers can manage and plan their financial and operational needs in one app. Although Bonsai is a bit more expensive than stand alone accounting software, it is a great choice for freelancers who want to manage everything about client work and finance seamlessly.

Features:

- Invoicing, proposals, and contracts in one place

- Automated expense tracking and tax estimation

- Time tracking and project management

- Integrated payments and reports

Pros:

- Comprehensive freelancer business toolkit

- Excellent UX and branding features

- Strong automation for invoicing and proposals

Cons:

More expensive than pure accounting apps

Some accounting features are less advanced

Pricing: Starts at $25/month (Workflow plan), with additional bundles for taxes and CRM.

Best For: Freelancers who want an all-in-one business suite with accounting, contracts, and proposals.

How to Choose the Right Accounting Software for Your Business

Finding the right accounting software depends on your budget, business size, and complexity. If you are a freelancer who only needs invoicing, you may seem to prefer Wave. If you are managing multiple clients and projects, you may find FreshBooks or Bonsai useful. You may want to consider:

- Budget: Are you looking for free software or can you pay monthly?

- Complexity: Does the software offer more advanced reporting systems or do you just need simple invoicing and tax tracking?

- Scalability: Will this software grow with my business?

- Ease of use: Can you just start using the software without relearning how you run your business?

- Tax support: Does the tool help with quarterly and annual tax prep?

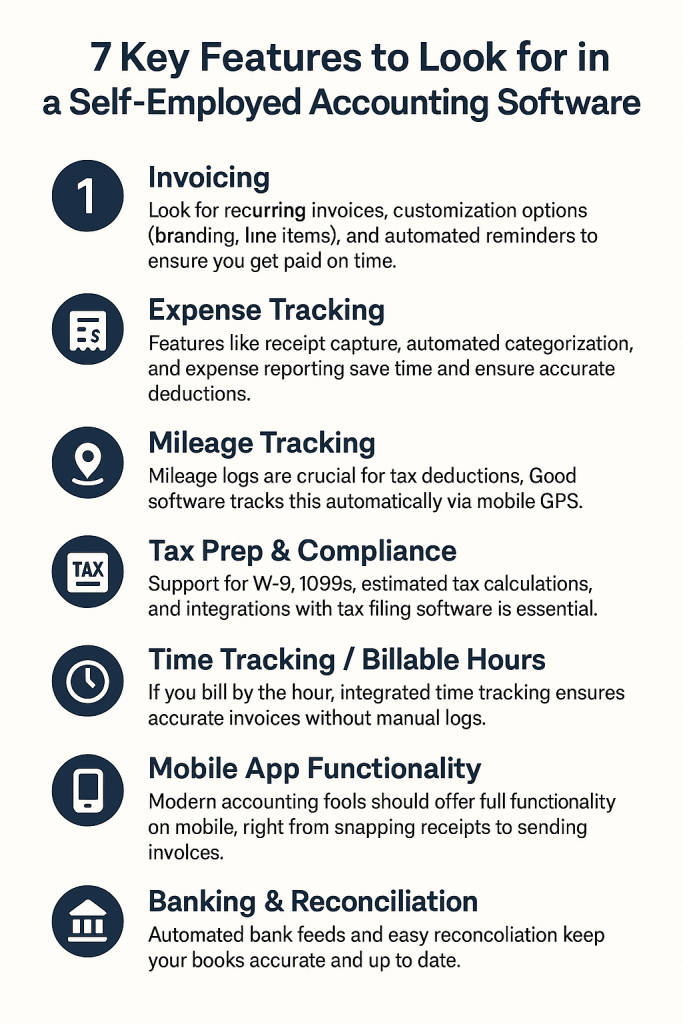

7 Key Features to Look for in a Self-Employed Accounting Software

1. Invoicing

Look for recurring invoices, customization options (branding, line items), and automated reminders to ensure you get paid on time.

2. Expense Tracking

Features like receipt capture, automated categorization, and expense reporting save time and ensure accurate deductions.

3. Mileage Tracking

Mileage logs are crucial for tax deductions. Good software tracks this automatically via mobile GPS.

4. Tax Prep & Compliance

Support for W-9, 1099s, estimated tax calculations, and integrations with tax filing software is essential.

5. Time Tracking / Billable Hours

If you bill by the hour, integrated time tracking ensures accurate invoices without manual logs.

6. Mobile App Functionality

Modern accounting tools should offer full functionality on mobile, right from snapping receipts to sending invoices.

7. Banking & Reconciliation

Automated bank feeds and easy reconciliation help keep your books accurate and up to date.

6 Common Mistakes to Avoid When Using Self-Employed Accounting Software

1. Mixing Personal and Business Expenses

Always keep separate bank accounts and credit cards to avoid messy records and compliance issues.

2. Inadequate Receipt Documentation

Missing receipts can hurt you during tax audits. Use apps with receipt scanning to stay organized.

3. Irregular Data Entry Habits

Consistency matters. Set weekly reminders to log transactions and review reports.

4. Ignoring Reconciliation Warnings

Unreconciled transactions can lead to reporting errors and tax issues.

5. Poor Category Management

Use proper expense categories to get accurate financial insights and maximize deductions.

6. Insufficient Backup Procedures

Cloud software usually includes backups, but exporting data regularly adds an extra layer of protection.

FAQs

Can self-employed software handle multiple businesses?

Yes, many platforms like QuickBooks, Zoho Books, and Xero allow multiple business profiles under one account, though you may need to pay for each.

Can I switch later if my business grows?

Absolutely. Most tools offer data export/import, making migration to a more advanced solution easy.

Are there truly free options?

Yes. Wave Accounting and ZipBooks offer robust free plans with core features like invoicing and expense tracking.

Does self-employed accounting software work on mobile?

Most modern tools include full-featured mobile apps for invoicing, expense tracking, and mileage logging.

Which accounting software lets me separate business and personal expenses?

QuickBooks Self-Employed is designed specifically for this, automatically categorizing personal vs. business expenses.

Final Thoughts

The best self-employed accounting software simplifies financial management, reduces tax-time stress, and frees up your time to focus on running your business. Whether you need a free invoicing tool like Wave, a powerful reporting system like Xero, or an all-in-one freelancer platform like Bonsai, there’s a solution that fits your workflow and budget.